Why Pay Fees For Financial Advice?

Almost everyone runs away from paid services. It’s because the focus is on fees and not the value. Why? We are simply programmed to try to acquire anything we pay for at a lower or may be even free of cost. Fees are not seen as an investment. They are considered as an “expense”. People look at fees as money that must be spent on something which is for immediate consumption rather an investment which can provide them with growth in the value of their wealth in the very near future.

When you fetch into the wrong product for tax savings or in the notion of insurance-cum-investment such as buying Endowment or Money back policies or even ULIPs which you don’t need and don’t understand, it is no wonder by such those type of tax people who are paying insurance premium of Rs 50,000 p.a., Rs 15,000 is lost the moment when you were signed the documents in the form of commission paid or premium allocation charges.

Whilst paying indirectly commission worth Rs 15,000 to their agents who are not supposed to produce any service and value to help in meet your long-term financial goals in the future, and yet these are the same people who say “15k fees for a financial planner – too costly who could make a drastic change in your financial life by just sitting with you and counselling you on your financial life and the mistakes you should avoid.

At PrudentFP, we can improve your financial life and enable you to reap benefits over the long term. Remember that free advice can turn out to be extremely expensive in the big picture sooner or later.

We are SEBI Registered Investment Advisors ( RIA ) & Fiduciaries. We only think of your best interests all the time; you can be sure of that as we don’t distribute products & are independent.

You pay us afee just at 1% and we will give you 99% clarity and peace of mind = 100% Committed Financial Success!

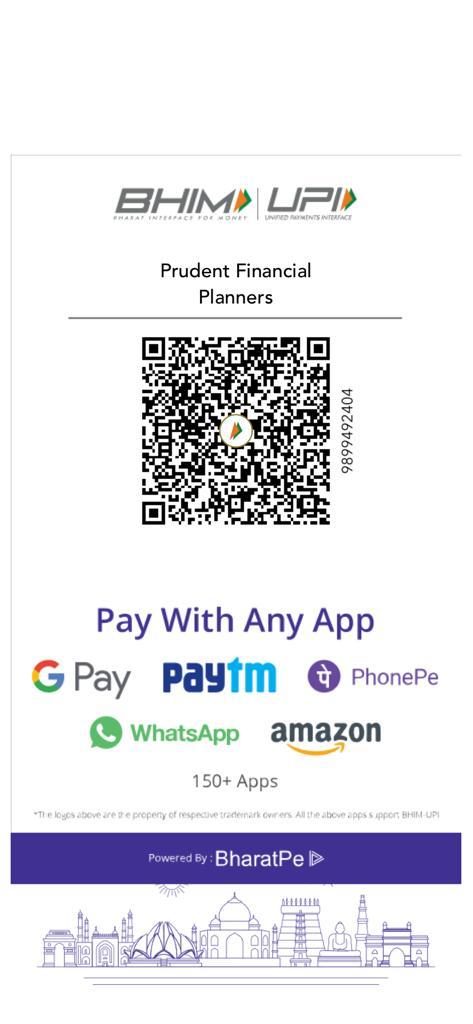

You can start this process either to pay through QR scan by your mobile with any Money App or you can also pay online by NEFT/IMPS transfer in favor of “Suresh Kumar Narula” under intimation to us.

Account Name: Suresh Kumar Narula

Bank Account No: 55143852692

Bank Account Type: Saving Account

IFSC Code: SBIN0016750

Bank Name: State Bank of India

Bank Branch: Sector 25, Panchkula (HR)-134116