About PrudentFP Wealth Elite Desk

This service through our web site is freely available only for exculsively our Financial Planning paid Clients and for those who have been investing in mutual funds through Prudent Financial Planners. It is an intuitive and easy to use tool which helps you keep maintain and track of your investments in Equities, Mutual Funds, Fixed Deposits/PPF/EPF, Postal Schemes, Gold, Life and Health insurance policies. The portfolio is valued on a real-time basis.It gives you a 360-degree view about how your investments are performing. Its unmatched features, reports and tools will help you in your investment decisions.

New Features of Wealth Elite :

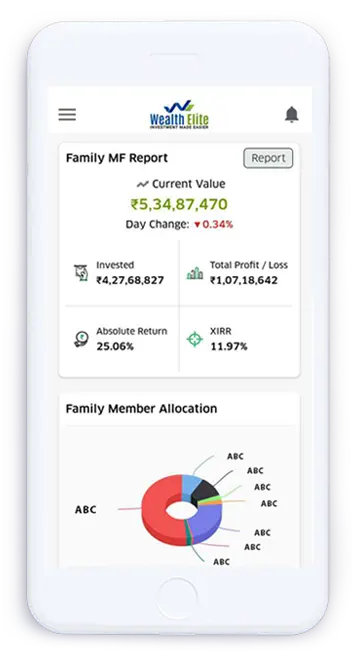

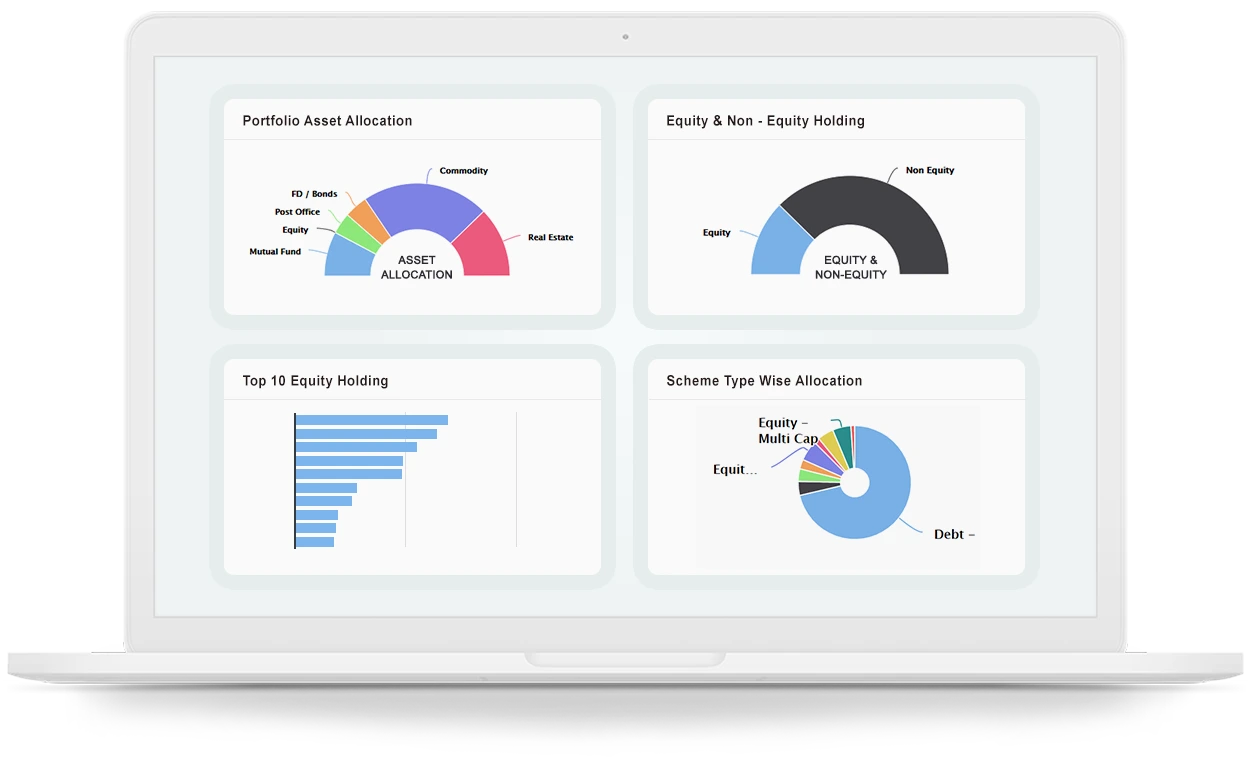

Pruductive Dashboard :

Get portfolio trends of the last 3 months on your dashboard that how your portfolio has been performing. Get instant view about your Family Current Valuation, Family member and asset allocation, Goal allocation, Cash flow, My SIPs and Upcoming EventsFamily or Individual Account level access :

You could login as head of Family and enjoy multiple viewing options with graphical view of your portfolio. Viewing options include Asset allocation across family portfolios and family account wise holdings.Manual Entries :

You can add/ edit and delete transactions across all financial products except mutual fund transactions to correct or build an accurate, single view of Net Worth.Powerful Portfolio Analysis :

Reporting the complicated data in most simple way is our expertise, get equity holding, sector exposure, debt paper qualities, fund type wise pie chart, goal allocations, family member wise exposure, SIPs, Capital Gain, What If Scenario in few clicks.Financial Planning :

At PrudentFP, get complete financial plan blueprint online at your Wealth Elite desk and your Mobile App with Insurance need analysis, post retirement cash flow, Goal report with client’s photo, Asset Allocation recommendations, Net worth analysis, solvency ratio and many more.Goal Tracker :

Exclusively designed feature for our paid Financial planning clients, to create their financal goals and map all their investments with the goals like child education, marriage or retirement etc. to check the gap of required corpus and planned their SIP investments and track their Goal achievements of the client with required return and current return via Goal GPS comparison mapped and additional required investments!Multiple Viewing Options :

You could custmized view your investments through multiple lenses, aiding your investment decisions by using our viewing filter options.Gains & Losses reporting :

Determine which investments have given what returns, segregated on Realized / Unrealized. Added feature of booked gains & losses bifurcated into Long Term & Short Term make handy inputs for filing your Tax returns.Research Tools :

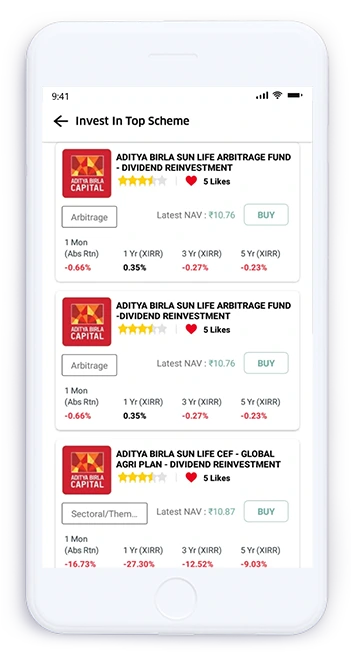

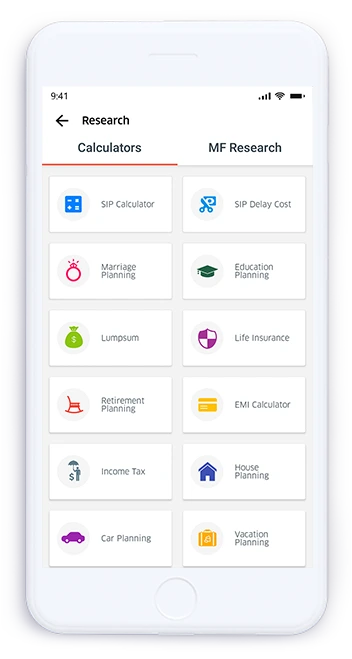

Our clients allow conducting research through Funds Factsheet, SIP/STP/SWP Past performance Calculator, Human life Value Calculator, SIP Calculator, Loan EMI Calculator, FD Calculator, Child Marriage planning Calculator, Child Education Planning Calculator, Retirement Planning Calculator, Dividend History, Latest & Historical NAV Watch, Income Tax Calculator, SIP Delay Cost calculator.Video KYC – Instant KYC from Anywhere :

The days were gone where initiating investment seems to be a long step process and involve physical presence of the parties as the investor had to visit authorized center for the verification. Instant full video KYC by invitation link for clients present in any part of the world.Auto update :

Mutual Fund Online/Offline Transactions done through Prudent Financial Planners are updated automatically at the end of the day in the Portfolio. We also auto update any NPS benefits accruing on your investments to give you a truly Automated experienceTransaction Online :

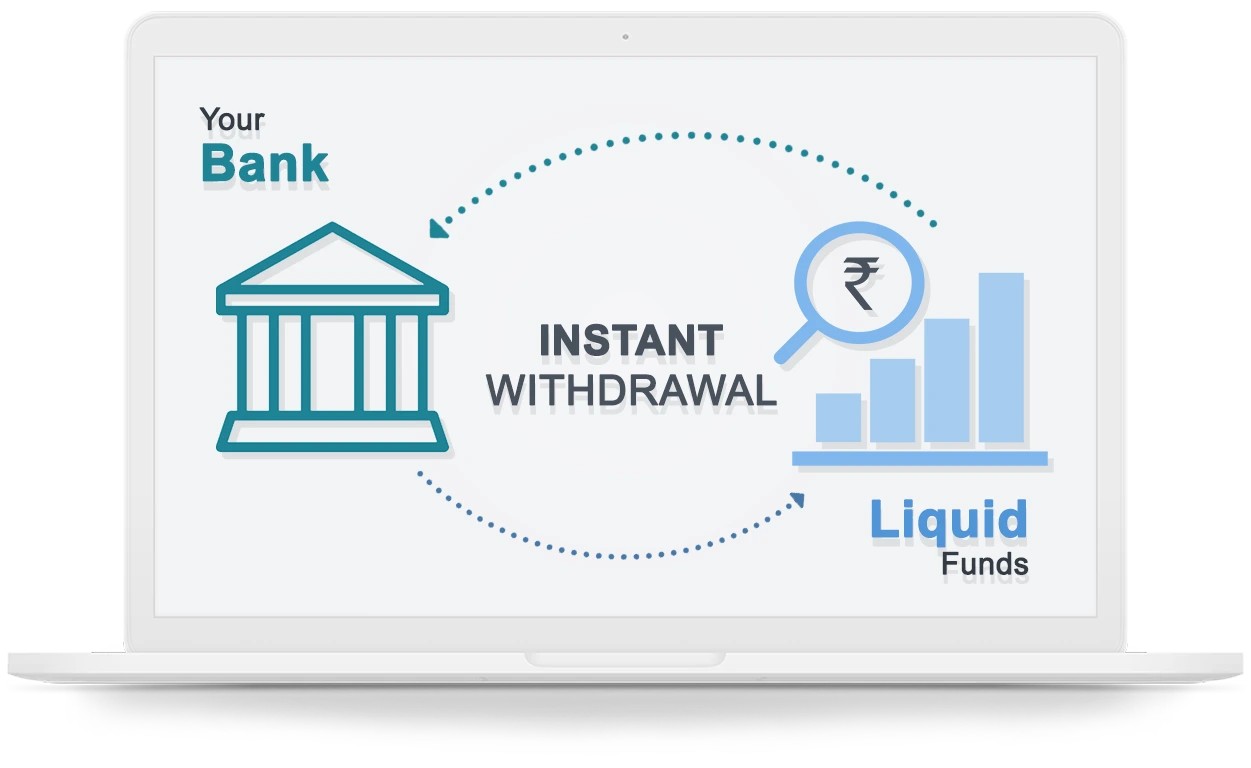

Online ATM: You keep money idle in bank a/c, this money can be channelized in liquid fund with Insta Redemption Feature and when you need, Online ATM gives facility to withdraw a maximum of Rs.50,000 or 90% of invested amount within 30 minutes to bank account.

Online Global Investing: If you dream of investing in Apple, Tesla, Facebook,Amazon, Netflix, or Google? Now, you can turn your dream into reality through our Wealth Elite desk invest in these global giants with Prudent Financial Planners. Get access to 4,000+ stocks & 3,000+ ETFs at your fingertipsPeer to peer Lending (P2P)*

Fractional Matchmaking Peer to Peer Plan (FMPP®) lending involves direct lending between individuals opening new investment avenues, and diversifying your portfolios beyond traditional options.It is one of the most preferred non-market-linked investment instruments offers you better returns than bank FDs.LenDenClub Peer to Peer Lending platform puts its best efforts into sourcing the right borrowers, and do thorough underwriting, information verification, and KYC checks.Loan againt Mutual Fund (LAMF)

You don't need to redeem your ongoing invested outperforming funds to fulfill your goal requirement. At PrudentFP, you may,now get online instant loan against your mutual fund portfolio to avoid any tax implication and to compromise your returns.National Pension Scheme(NPS)

The National Pension Scheme (NPS) is a pension and investment system developed by the Indian government to give long-term financial security to Indian residents. You can now subsribe and make subsquent contribution online through our Wealth Elite Desk and at Mobile App.Initial Public Offerins(IPO)

You can now directly apply upcoming IPOs for equity shares in the primary market through our Wealth Elite desk.Conclusion :

Diversification is all about broadening your investment spectrum to cater to diverse your needs and getting you better returns while expanding investment streams. At PrudentFP, Wealth Elite, a reliable enables you to easily offer and manage all these assets through a single platform, making investment growth convenient for you with multiple revenue streams.

More to Come :

Disclaimer

We do not promise that the investments you make based on this plan will be profitable. Investments are always subject to domestic and global market, currency, and economic, Geo-political and business risks. We will not be liable for any losses that may be caused directly or indirectly by such investment decisions. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

*P2P Risks

There is still a possibility of fraud or credit default risk for the borrower. It’s part and parcel of any lending activity. If a borrower does not repay, the platform uses various channels (which follow all RBI-specified guidelines) to recover the funds and ensure you receive your funds back. This includes digital follow-ups, physical meetings with the borrower, and initiating a legal recovery process against the borrower.In this regeard, Platform may charge you a Facilitation Fee, Collection Fee and Recovery Fee, if any payment of default.